Supply chain in the context of today’s economy

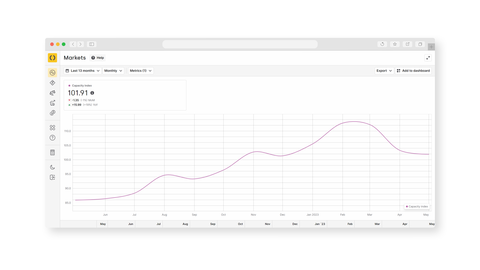

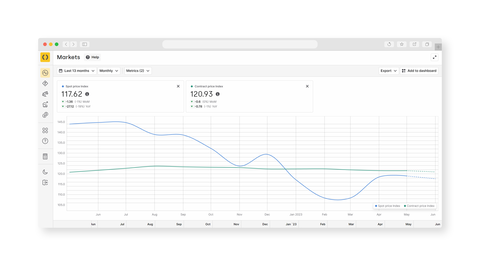

For over a year now, the economy has shown signs of sluggishness, and the outlook remains uncertain. According to CNBC's report on 8 June, the euro zone slipped into a recession in the first quarter of the year, with economists lacking confidence in the upcoming months.

Furthermore, the Wall Street Journal elaborated that economists forecast a slow and prolonged recovery for the continent in the latter part of this year, based on all known factors contributing to the situation right now. Both consumers and businesses are experiencing the burden of higher borrowing costs as the European Central Bank persists in raising interest rates to combat inflation. Unsurprisingly, overall sentiment towards the economy and inflation is fairly pessimistic.

Business advisory firm BDO says supply chain pressures continue to plague mid-sized businesses [in the UK] with 77% facing persistent disruptions in their supply chains – revealed by findings from a survey including 500 medium-sized businesses. The BDO press release dated 5 June adds that “Faced with these prolonged pressures, almost half (49.8%) of mid-sized businesses say they will be focusing on onshoring as much of their operations as possible in the next 12 months.”

The survey reveals that this onshoring trend is being driven by several factors, including a desire by companies to “reduce the impact of global geopolitical events on their business [and] a wish to avoid complex post-Brexit customs regulation.”

The onshoring trend extends beyond the UK. Despite an economic downturn in the region, manufacturers worldwide are acquiring European factories, driven by geopolitical and supply chain concerns, leading them to relocate operations closer to their customers. It is however easier said than done, as one of the biggest challenges is getting your suppliers and other trading partners to make the move too.