Ocean Market Trends Europe – East Asia, April 2023

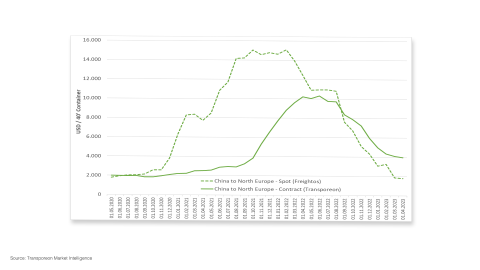

Spot rates out of Asia failed to rally after Chinese New Year, but the decline is slowing down as we approached pre-Covid levels. After a momentary recovery, Asia-to-Europe spot rates decreased again. Contract rates on most long-haul trades continue their decline towards the spot rate level.

At the TPM 2023 conference, carriers claimed a moderate rate recovery would come soon, while shippers remain skeptical.

Carriers align their capacity with the falling global demand to raise rates. Their ordering activity is decreasing while the number of idled ships is growing. It is not expected that carriers will have the discipline to return idling to early 2020 levels for a prolonged period of time.

High inflation and energy supply constraints are creating strong headwinds that are slowing economic growth. S&P now projects global real GDP growth to slow from 5.9% in 2021 to less than 2.0% in 2023. The period of weakest growth and highest vulnerability started in late 2022 and is continuing now; a new major shock could tip the world economy into recession.

A grab bag of smaller news items offers a glimpse at ongoing strategic repositioning underway by carriers:

- MSC reportedly tested multiple second-hand methanol and LNG powered vessels.

- ONE ordered 10 new vessels using methanol or ammonia with a capacity over 13,700 TEU (Twenty Foot Equivalent Unit). This is in line with their green strategy to achieve carbon neutrality by 2050.

- Hapag-Lloyd announced a general rate increase from East Asia to North America for cargo transported in 20’ and 40’ dry, reefer and special containers starting from May, 1, 2023.

- A.P. Moller Capital acquires Vector Logistics, the leading frozen logistic operator in South Africa.